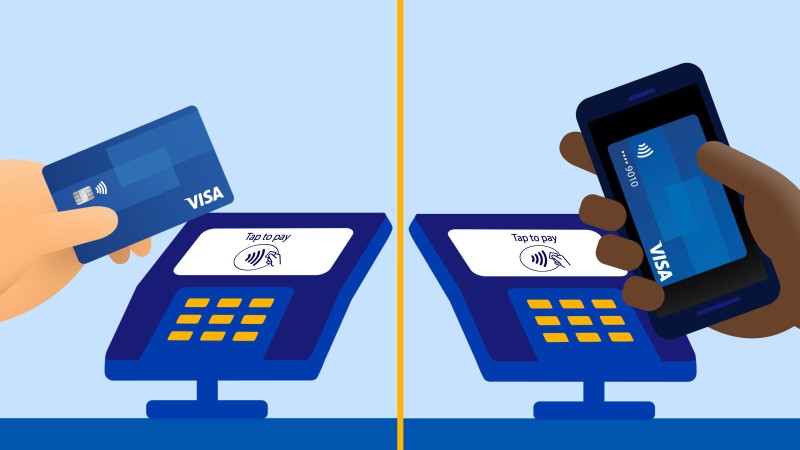

When you want a quick and simple way to pay for your essentials, tap and pay with Visa contactless (up to £100). Contactless payments are touch-free with no need to type in your PIN or hand over your card. Simply touch your card to the reader, listen for the beep, and your payment is securely processed.

Tap and pay the secure way, up to £100 with Visa contactless

visa contactless consumer

How to tap to pay with Visa (contactless payments)

Fast transactions.

Secure payments.

You can use your contactless Visa cards to pay for even more, as the payment limit has increased to £100 and is being rolled out by retailers across the UK. Check in-store for availability.

How do I use my contactless card?

Different ways to use contactless

Pay with contactless on your mobile

Apple Pay with Visa

You can use your Visa card to make purchases using your Apple Watch, iPad or iPhone (6 or later)¹.

Google Pay™ with Visa

Google Pay (formerly Android Pay) allows you to pay with any Visa card from participating issuers, from a range of popular devices, whether you’re making in-store or in-app purchases.

Samsung Pay with Visa

Samsung Pay allows you to make mobile contactless payments with a range of Samsung devices. It’s accepted almost everywhere† you can tap a normal contactless bankcard.

¹Apple Pay is available on your iPhone, iPad, Apple Watch, Mac or Mac Book pro. You can find a full list of Apple Pay compatible devices here: https://support.apple.com/en-gb/KM207105.

Apple, the Apple logo Apple Pay, Touch ID, iPhone, iPad, Apple Watch, iTunes, iSight and Passbook are trademarks of Apple Inc., registered in the U.S. and other countries.

†Samsung Pay is available with participating banks and merchants on selected devices. Samsung and Samsung Pay are trademarks or registered trademarks of Samsung Electronics Co., Ltd.

The Contactless Symbol is a trademark of EMVCo, LLC registered in the UK, US and other countries worldwide

Tap and pay over £100 with your mobile

You can still make contactless payments on your phone over the £100 limit but they require authentication through a password-protected phone, or through entering your PIN.

-

-

As contactless payments become the standard method of payment for purchases under £100, your bank will usually issue you with a contactless card automatically when your existing one expires. Otherwise, you can apply for a new contactless card from your bank in the same way you would apply for any other Visa card. Check with your bank for an update on what Visa contactless cards are available.

-

-

There are more than one million places where you can use your Visa contactless card, mobile phone or wearable in Europe, 400,000 of which are in the UK. So it’s everywhere you want to be, including retailers like M&S, McDonald’s, Starbucks, WHSmiths, Post Office, EAT, Pret A Manger and The Co-operative Food, as well as many pubs and bars, independent stores, and across all of the Transport for London travel network including London Underground and London buses.

-

-

While the contactless card limit is £100, you can now make payments over £100 using your mobile phone, providing your bank and the merchant in question authorises them. It’s more secure than carrying cash, and quicker than Chip and PIN.

-

-

Contactless payments are more secure than carrying cash for a number of reasons:

- The information on your card is protected with secure Chip and PIN technology. Data transmitted during transactions is encrypted and protected with a digital signature that is much harder to forge than a handwritten one.

- If your card is lost or stolen, or used fraudulently, our Zero Liability Policy protects you against unauthorised payments. Inform your bank immediately if you see a payment you don’t recognise.

- If your card does fall into the wrong hands, the maximum amount per transaction is £100, and after repeated payments, the person will be asked for a PIN. For payments over £100, authorisation is required, so nobody can make purchases without your PIN or mobile phone passcode.

- Each time your contactless device interacts with a payments terminal, it generates a one-time-only electronic signature and cryptogram, making it just as secure as a normal Chip transaction.

- For payments over £100, the person would first need passcode access to your mobile phone. Even then, PIN validation would usually be required, especially if your bank noticed unusual spending patterns or locations.

-

-

No. Visa contactless cards are very secure indeed. In fact, fraud levels for contactless cards are lower than for non-contactless cards. Thanks to the chip and PIN technology, contactless payments are very unattractive to fraudsters.

-

-

No. First of all, the contactless chip needs to be very close to the terminal (always less than ten centimetres and usually less than two centimetres) – so generally a tap of the card or phone above the terminal is required to make the payment.Also, in a typical transaction, the sales assistant has to enter the amount for you to approve first, and then your card or mobile phone has to be held within a couple of centimetres of the terminal for longer than half a second. You should never be asked to hand over your card or mobile phone for a contactless payment.

-

-

No. None of the information useful to today’s fraudsters, such as the three-digit CVV code, PIN, Visa passcode, card security code, billing address and other hidden security data, can be read from a bogus terminal.

-

-

No, your data is secure. Only your bank can update or change the data on the card.

-

-

No. You can only pay once for any transaction. The terminal will not accept two payments for one purchase – just like if you were using Chip and PIN.

-

-

No. The Visa contactless technology has ‘anti-collision’ features; this means that if two cards are held to a terminal only one payment will be processed. Or, in some cases, the entire payment may be cancelled. If you do have more than one contactless card, it’s always best to present the one you want to pay with to the terminal – and leave the other in your purse or wallet.

-

-

If an Oyster card and a contactless card are presented simultaneously, the Oyster card will generally take priority and be used for the payment. In some cases, the entire payment may be cancelled. You can be sure that only one card will ever be charged. But it’s always best to present the card you want to pay with to the reader – and leave any others in your purse or wallet.