Executive Summary

The report, “Decoding AI Adoption in the Nordic Retail Banking Sector”, evaluates the AI maturity of 44 Nordic incumbent and challenger banks, uncovering critical insights that will shape future competitiveness. While the sector has experienced sustained growth, evolving consumer expectations and the rise of digital-first competitors—accelerated by AI—pose significant challenges.

Key findings reveal that neobanks are outperforming traditional players in translating AI investments into profitability. Our research reveals regional disparities, with Swedish incumbents trailing their Nordic peers.

Customer service currently delivers the greatest value from AI, with 64% of banks reporting high or transformative improvements, followed closely by product development at 59%. A formal AI strategy is a decisive differentiator: 77% of banks with a defined strategy demonstrate higher maturity and stronger revenue generation. Furthermore, robust C-suite engagement is essential for driving successful AI initiatives.

To thrive, banks must articulate a clear AI strategy, secure executive sponsorship, and collaborate with trusted partners to navigate the complexities of this fast-evolving technology. These actions will enable institutions to meet shifting consumer demands and unlock sustainable growth.

The three pillars of successful AI implementation

What is holding them back

Outdated legacy systems

- Legacy systems create difficulties deploying AI systems, even when the data is available

- Neobanks view this as their biggest advantage

Navigating the change in talent needs

- The deployment of AI systems and the use of GenAI APIs requires a radically different skillset

- The need for talent that can both frame business problems to AI problems and software engineers that can deploy solutions is on the rise

Internal resistance to automation

- Fears of replacing FTE’s with AI is present at both incumbents and neobanks

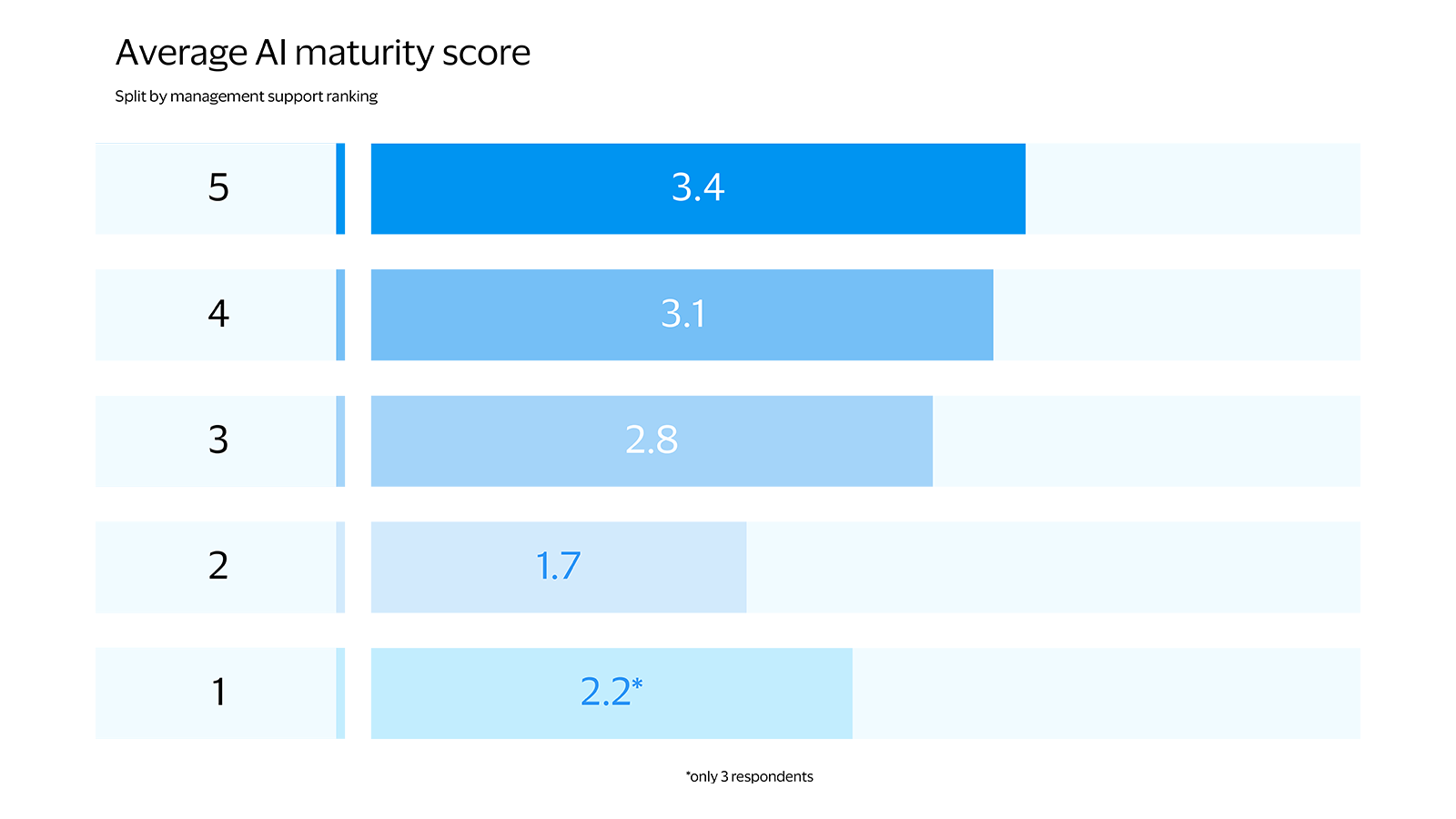

We have scored Nordic banks based on AI maturity and identified a strong correlation between C-suite commitment and high-level of AI adoption

Key findings

Three key insights

You may be interested in

REGIONAL INSIGHTS

REGIONAL INSIGHTS

REGIONAL INSIGHTS

Fragmented yet thriving: the Nordic payment landscape in 2024

Sources

- The Global AI Index, Tortoise Media: https://www.tortoisemedia.com/data/global-ai

- Visa Consulting & Analytics, Fragmented yet thriving: the Nordic payment landscape in 2024: https://www.visa.co.uk/content/dam/VCOM/regional/ve/unitedkingdom/PDF/vca/ukfragemented-yet-thriving-the-nordic-payment-landscape.pdf